ประวัติส่วนตัว

ปริญญาเอก สาขา PhD in Finance The University of Leeds ปีที่จบ 2550

ปริญญาโท สาขา วิทยาศาสตร์มหาบัณฑิต (สาขาการเงิน) จุฬาลงกรณ์มหาวิทยาลัย ปีที่จบ 2542

ปริญญาตรี สาขา บริหารธุรกิจบัณฑิต (สาขาการเงิน) มหาวิทยาลัยเกษตรศาสตร์ ปีที่จบ 2538

ประวัติการทำงาน

คณะวิทยาการจัดการ มหาวิทยาลัยเกษตรศาสตร์ วิทยาเขตศรีราชา ปี 2542 – ปัจจุบัน

ฝ่ายบริหารเงิน และ ฝ่ายการค้าต่างประเทศ ธนาคารกรุงไทย จำกัด (มหาชน) ปี 2538 – 2541

ผลงานวิจัยโดยสรุป

Introduction:

In 2009, the G-20 group identified poor governance and a lack of effective corporate accountability as the contributors to the 2008 financial crisis. It is to be expected that uccessful shareholder activism will result in improved future share price performance and operating results as well as governance changes. However, not all activism is equally effective. CalPERS is one of the largest and most prominent institutional activists in the US. The announcement of CalPERS focus list obtains substantial media attention and is regarded as newsworthy and unwelcome event. The focus list firms have performed poorly in the recent past and have governance structures that limit shareholder influence on management

Theoretical Framework and Testable Hypothesis:

Almost all previous research on the CalPERS activism focuses on an agency theory framework and is based on the assumptions that all investors devote full resources to the investment decision. Recent research has relaxed this assumption. Investors are unable to devote their full cognitive attention to their investment portfolio. If market participants are unable to devote their full cognitive resources to the investment decision, limited attention leads them to focus more on industry and sector factors than firm level factors (Peng and Xiong, 2006). When investors have limited cognitive resources, the way in which information is presented is value relevant (Hirshliefer and Teoh, 2003). Given that news is a public good and free, the incorporation of this information has a trivial resource cost. Expected investor utility is maximized by assessing the news on a superficial level (Joe, 2003). If investors are constrained to focus on their investment portfolio, new media information possibly has a disproportionate effect on their investment decisions

Two main testable hypotheses are developed. First, companies that have limited investor attention will have a stronger share price and volume response to inclusion in the CalPERS focus list. Second, given the larger market reaction in limited investor attention firms, focus list inclusion will lead to greater operating performances and governance reforms than in other firms

Data:

Between 1990 and 2007, a total of 144 companies were listed in the CalPERS focus list. To be included in our final sample, the firm must have complete information in the CRSP, Compustat and the Gompers, Ishii and Metrick (2003) corporate governance index database. In addition, we omitted both contaminating events and repeat offenders. In total, there were 58 uniquely identifiable CalPERS focus list events with full data and without any contaminating news.

Summary of findings:

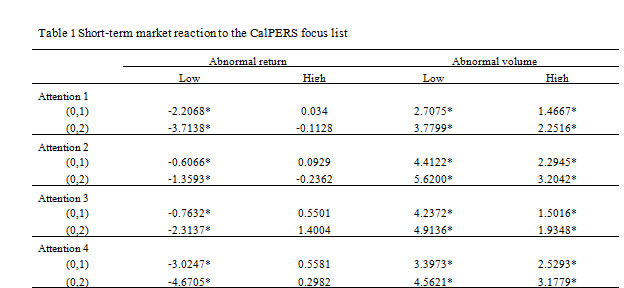

To identify the types of firms targeted by CalPERS, the CalPERS focus list is compared with a control sample of firms, matched on size, industry and corporate governance. Prior market share price and accounting performance of target firms is exceptionally poor. CalPERS focus list firms have significantly lower investor attention values for the Corwin and Coughenour (2008) attention proxies. Further, the sample is divided into low- and high-investor attention categories. For all attention proxies, firms with limited investor attention have a significantly negative abnormal share price response whereas for high investor attention firms, there is no effect on share prices over the two-day event window. Both samples show an abnormal increase in trading volume, providing further evidence that the focus list is an effective tool in changing investor sentiment in the short-term.

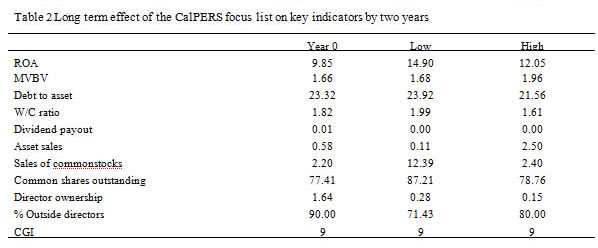

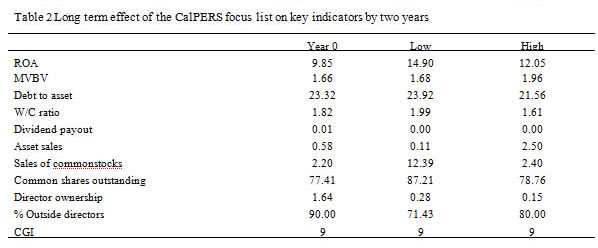

To determine whether long-term corporate strategy responds to CalPERS activism and if this is accentuated by cognitive shareholder biases, we compare performance, leverage and governance two years after the focus announcement and test for a significant change for low and high investor attention samples. The focus list appears to be successful in improving performance over the long-term without any corresponding improvement in corporate governance.

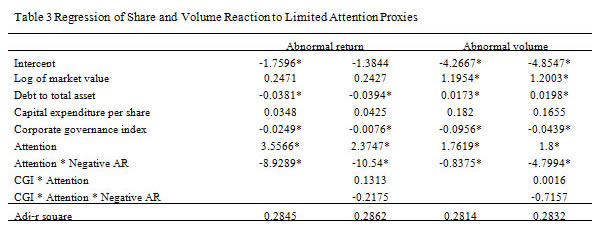

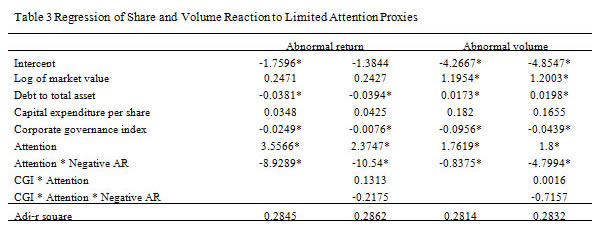

We next analyze the effect of firm-level, corporate governance, and investor attention characteristics on abnormal returns. Firms with low investor attention react significantly more negatively to focus list inclusion than high investor attention firms. The volume regression results also confirm that firms with attention constrained investors have a stronger reaction to focus list inclusion than other firms.

Some additional tests are done to ascertain the validity of our central results. Limited investor attention firms that appear on the CalPERS focus list for the first time experience a significantly negative abnormal share price reaction. Competitor firms experience a similar response to activism events as the target firms themselves. Our abnormal returns are also quantitatively and qualitatively similar to previous research.

Conclusions:

The share price and volume response to being included in the focus list is a function of the investor attention in a stock, which in turn has an impact on the subsequent managerial response. This suggests that when attention is a scarce cognitive resource, the proactive exploitation of news signals can be an efficient activism strategy.

References:

- Corwin, S.A., & Coughenour, J.F. (2008). Limited attention and the allocation of effort in securities trading. Journal of Finance, 63, 3031-3067.

- Gompers, P., Ishii, J. and Metrick, A. (2003). Corporate governance and equity prices, Quarterly Journal of Economics, 118, 107-155.

- Hirshliefer, D. & Teoh, S.H. (2003). Limited attention, information disclosure, and financial reporting, Journal of Accounting and Economics, 36, 337-386.

- Peng, L., & Xiong, W. (2006). Investor attention, overconfidence and category learning, Journal of Financial Economics, 80, 563-602.

|